Free Deposit Invoice Template Sample

Deposit can be defined as a transaction which engages persons in monetary obligations to transfer money for safekeeping, installment, payment, or other personal purposes. One of the examples receiving deposit is bank. Anyway, you have to know the right format of deposit invoice template.

How to Write a Deposit Invoice Template

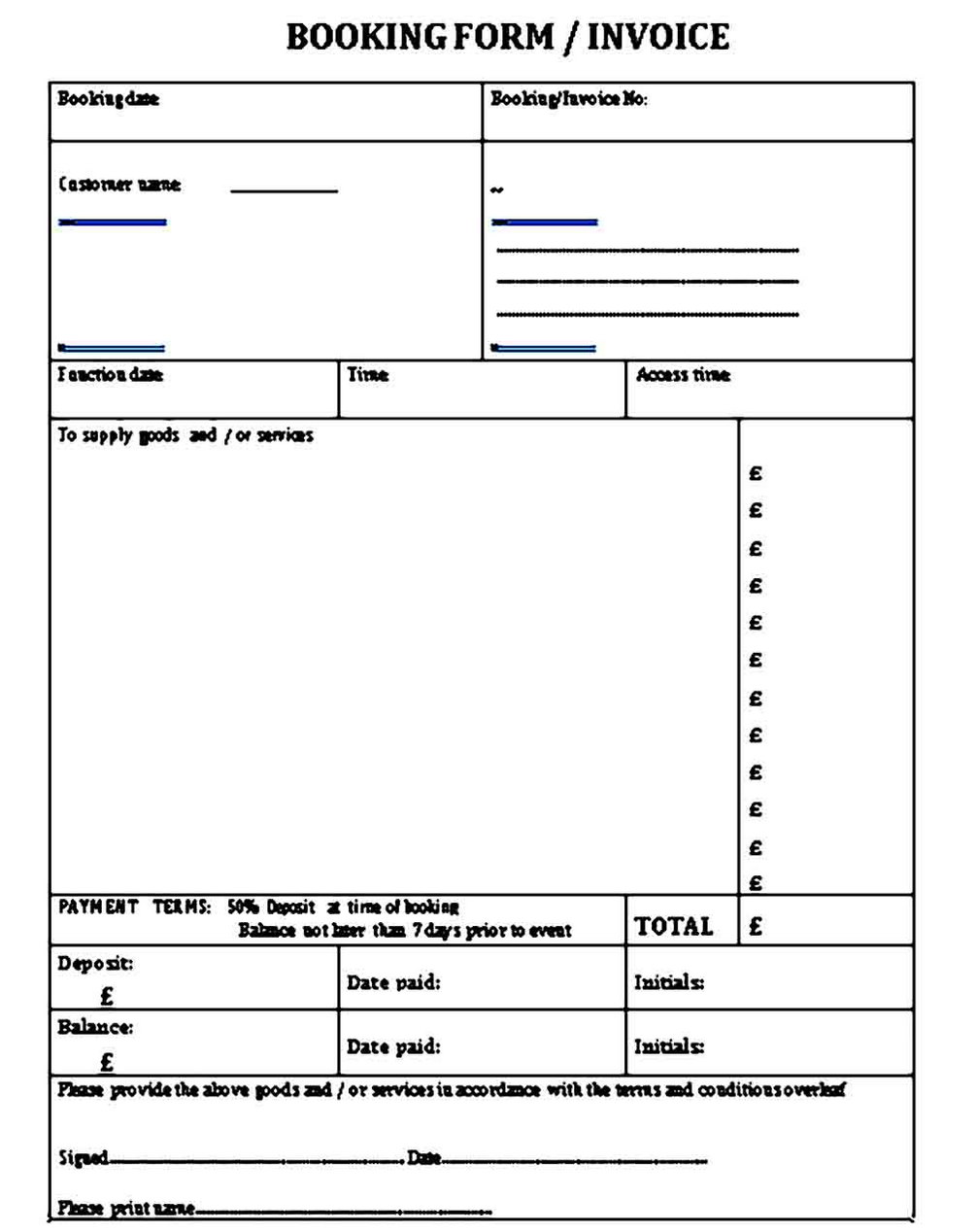

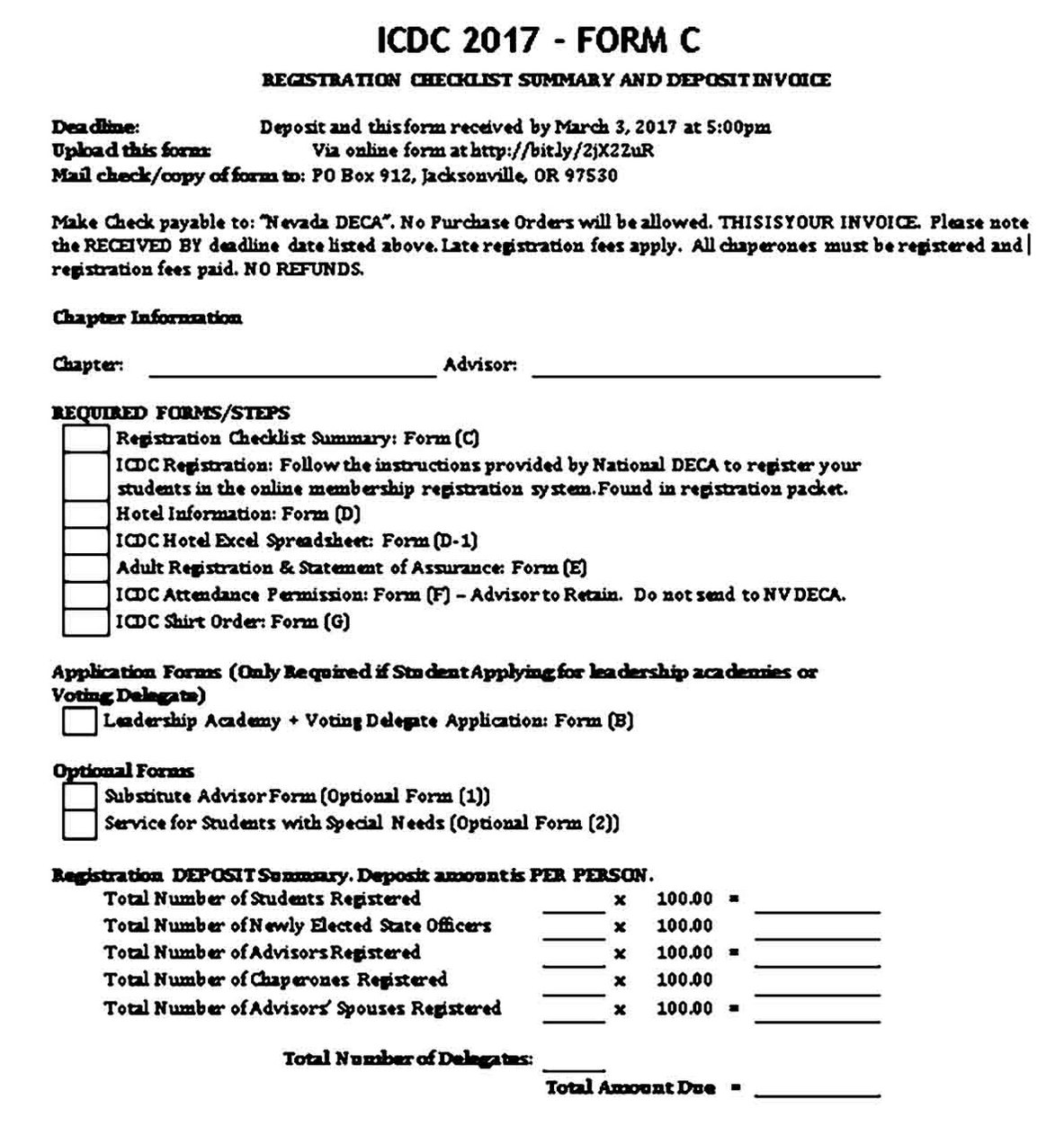

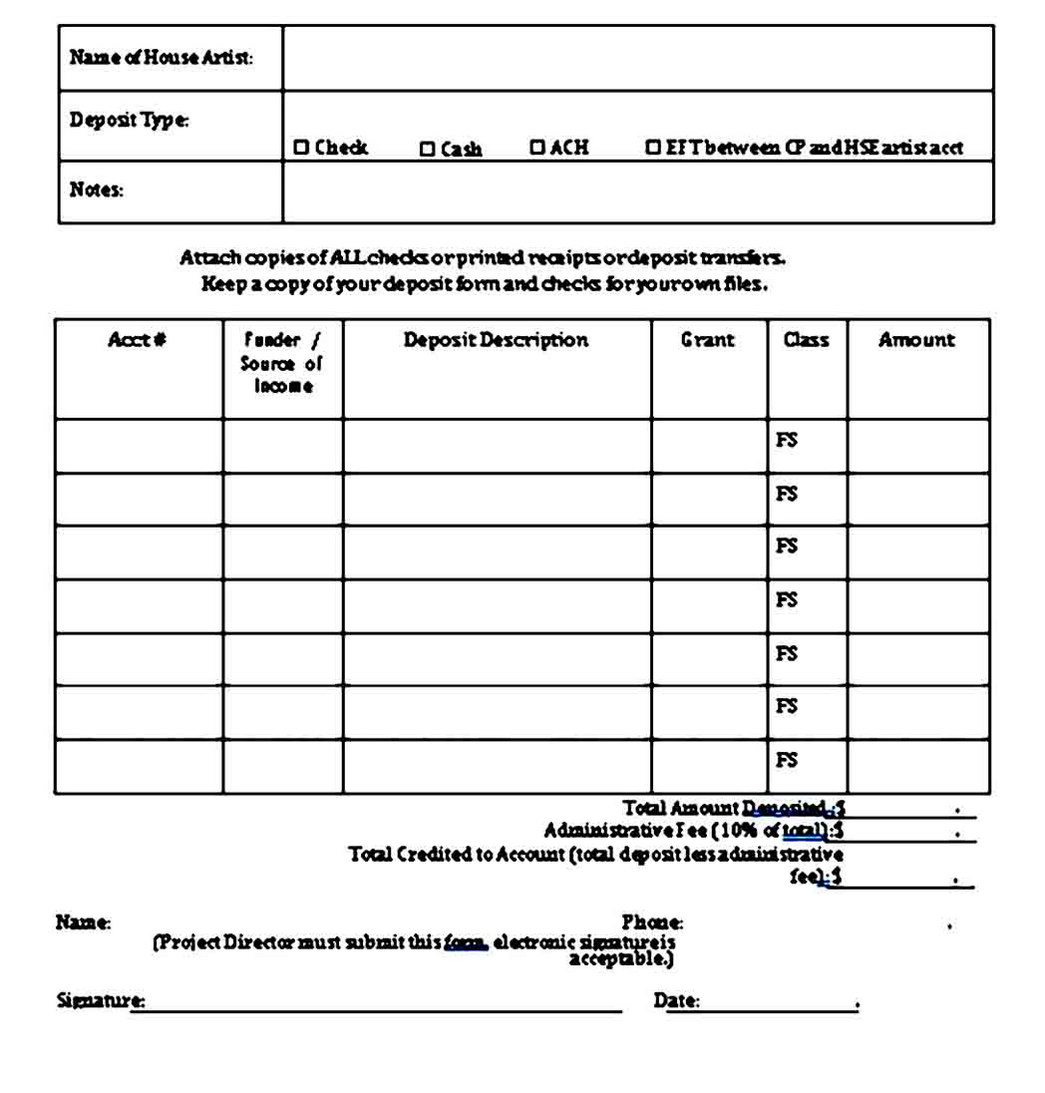

A deposit invoice form monitors the accuracy of data inputted with the actual numbers involved in the daily deposit transaction. This invoice contains some details of information. Therefore, you have to know about the information required to be included in the template of a deposit invoice.

Basically, there are 3 important details that you have to provide in a deposit invoice. They are identification, item description, and total amount. Let’s discuss them all one by one so that you can understand and you will be able to make a deposit invoice by your own then.

Let’s start from identification. Deposit identification is commonly written at the topmost part of a deposit invoice. It aims to simply identify what a specific deposit transaction is for. In fact, there are many types of deposit. For example, you will make a security deposit invoice, tax deposit invoice.

After deposit identification, it should be continued with item description. All kind of deposit invoice must include descriptions of item so that it will be easy to use in incorporating details of deposit which correspond to various items. Anyway, describe the items as detailed as possible.

A deposit receipt form also needs to include total amount. Total amount of all items should be presented in the deposit invoice clearly. It aims to fully serve the purpose. So, the deposit invoice will be convenient to everyone who will need this form. It must be stated clearly in numbers.

It is very important to know how to invoice rightly for an advanced deposit of payment. In this case, there are 3 important steps that you have to follow. In fact, an advance payment deposit has a tendency to get mixed up with other deposits especially if you do not really monitor it well.

Let’s check it out one by one carefully. Firstly, you have to specify the date exactly. As we know, this deposit is labeled that way for a purpose. So, you have to be particular with the date in a way you are able to follow a pattern for all transactions of your advance deposit.

After that, you need to make a schedule. It aims to record the payment you give ahead of time. You have to ensure to note the payment deposits you made before the due date in the schedule. You can add information of advance payment deposit or any other relevant detail.

Lastly, you have to take note of the depositor information. For anyone who engages payment transactions in advanced, you have always to take note the depositor information to monitor it accurately. That is all what you need to know about a deposit invoice template. Hope this is useful.